When referring to your credit report, the various parties are talking about the track record of your payment history. There is no analysis, comparisons, or judgment. However, with your credit score, they refer to a cumulative number that weighs your success in comparison to others and categorizes you as a creditworthy borrower or otherwise.

Your credit score is critical because it touches on several areas of your financial life, such as getting approved to take a credit card, what interest rate you will be charged for your loans or mortgage, and so on. It is advisable to get a good understanding of the number and how it is computed to have control over your finances.

Credit scores defined

A credit score is a number that enables lenders (and other parties) to determine how responsible you have been with your financial obligations. The three-digit number helps to show if you will pay your debts on time. It indicates one’s reliability with debt and financial management as a whole.

The commonly used score from FICO ranges between 300 and 850. With the FICO score, the higher the number, the better the score. Any rating that is above 740 is deemed to be excellent and will enable the borrower to get the best rates for loans or other products. However, for scores that are below 650, the borrower will be charged interest at very high rates for cards and loans, and that is if they even qualify for them.

How a credit score is calculated

Your credit score is computed using the information in your credit report. Since some aspects of your history of settling obligations are more important than others, the different portions are apportioned varying weights when working out your score.

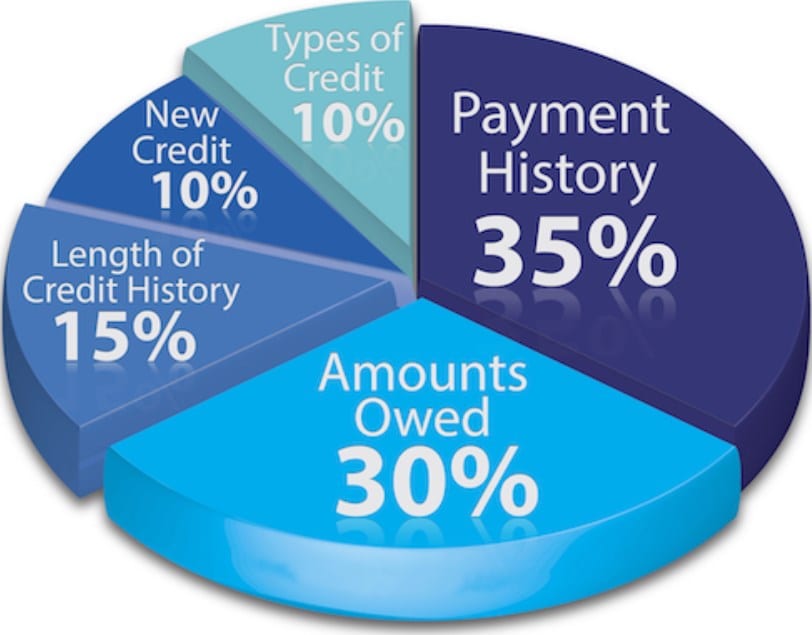

The specific equation for calculating your score remains a secret and is proprietary information of FICO, but the various factors that determine your FICO credit score are well-known. Here we will look deeper into the five FICO elements and their contribution percentages:

1. Payment History

Did you know that your payment history is the most important element when it comes to calculating your credit score? Well, it carries the highest weight at 35% of the overall score. FICO believes that long-term behavior portrayed in the past can be used to predict future long-term behavior.

FICO pays close attention to both revolving loans, like credit cards, and installment loans, which include student loans, mortgages, and others. Concerning missed payments, it takes note of the recency, frequency, and severity. It is also worth noting that FICO does not consider missing a loan payment worse than missing a card payment.

Timely and consistent payment of bills or obligations is one of the best ways in which borrowers can boost their credit scores. This is because it will build an impressive payment history, and since it is the highest weighted factor, it will greatly improve the rating. While it was hard to use this approach previously since one had to rely on lenders, suppliers, landlords, and other creditors to forward the information to the credit bureaus, it is easier nowadays. The 2019 launch of Experian Boost enabled individuals to be in control of their scores since they can report their good debt management and repayment behavior.

But does it mean that there is no hope for you if you have a bad payment history? Absolutely not. You can start to rebuild your score by being timely with your payments and using seasoned tradelines. For effective and faster recovery of your score, you can engage credit repair experts to advise you on this approach. To understand how credit boosting using tradelines works, check here for more information.

2. Credit utilization

The sum of your debt in comparison with your debt limit is referred to as credit utilization and accounts for 30% of your score. For a high credit rating, you should avoid having your debts getting close to your limit. The reason for this is that FICO views those who have a habit of maxing out their credit cards as people who cannot manage debt responsibly.

It is recommended to keep your credit utilization at 30% of your debt limit or below. However, some experts say that there is no benchmark for the utilization ratio that will maximize your score since it is measured for each card and across several cards.

3. Length of credit history

How long has each account been open, and how much time has elapsed since the account’s most recent activity? The longer the time each account has been active, the better. This element makes up 15% of your score.

Longer credit history is deemed favorable as it gives more details and portrays a better image of your long-term financial behavior. To improve their scores, those with no credit history should start using debt, and those who have to need to keep their long-standing accounts. Fortunately, individuals without long credit histories can get excellent scores if they have not missed payments and have low utilization ratios.

4. New credit

New credit contributes to 10% of your FICO score, but does that mean that opening several debt accounts simultaneously will improve it? No, that is not the case. It could give the impression that you are in financial distress, and you are taking out one product to pay for another, which is a disadvantage for your score. Furthermore, new accounts will bring down your average account age. This can have a significant effect on your rating if you do not have other credit information available. You should ideally spread those debt applications over time or open them when there is a need.

5. Credit mix

This element sounds vague, but it accounts for 10% of your score. The reasoning behind considering credit mix is that repaying various types of debt products is an indicator that one can responsibly manage all kinds of credit. FICO says that historical data shows that borrowers with a good mix of revolving credit and instilment loans pose fewer risks to lenders. A good history of credit cards and installments will help to boost your score.

Bottom line

With the understanding of how your credit score is calculated and the factors that affect it, you can focus your efforts on the relevant elements. For example, you can focus on timely payment and keeping your credit utilization ratio low, which, when combined, makes two-thirds of your score. You may then engage experts to help you boost your score, and it will be more effective and faster.