It boggles the mind why America’s school systems don’t spend more time teaching kids practical things they can use in their lives. When was the last time you heard of a school teaching students how to balance a checkbook or make a personal budget? The answer is likely never. That puts the responsibility for teaching your child about personal finances squarely on your shoulders.

As a parent, it might not be clear to you exactly what kind of knowledge you need to impart to your child. The following information should serve as a reminder of what information your child could use to make sure they can successfully handle their personal finances without getting into financial trouble.

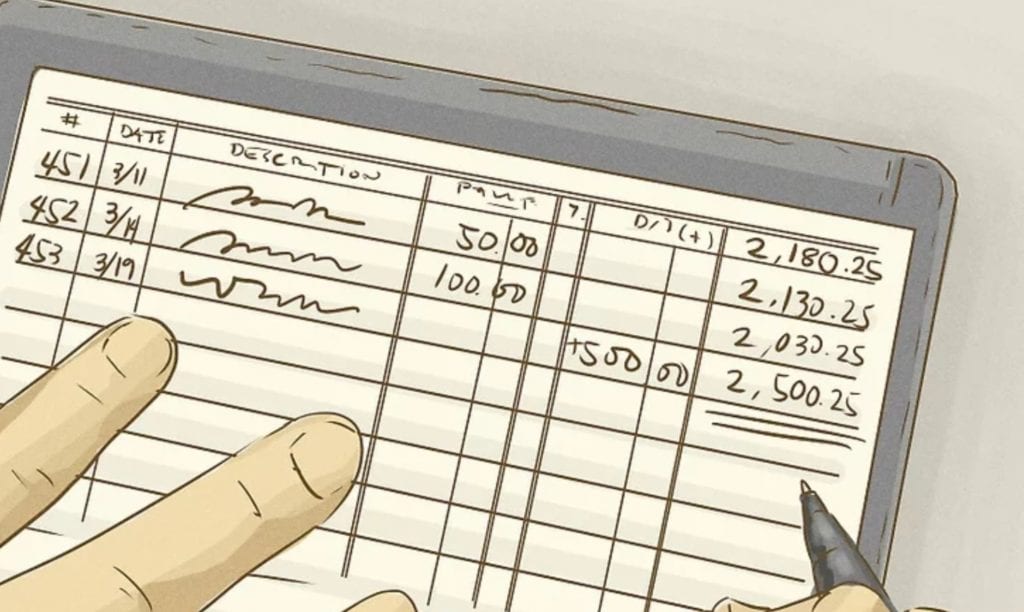

How to Balance a Checkbook

The day your child calls you and says they are overdrawn but don’t know why is the day you will realize your child doesn’t know how to balance their checkbook. It’s amazing how many kids forget to enter transactions and always seem to forget about service charges. You need to teach them the importance of entering every transaction, opening every back statement (or checking online) and making sure everything has been recorded.

How to Prepare a Personal Budget

This budgeting process is not as complicated as you might believe. The first thing you need to teach your kids is money is finite. They can’t just spend money at will. After that, you need to make sure they understand the differences between needs and wants. They need to pay rent and can probably do without going to a fast-food restaurant.

You should suggest they lay out their budget as follows: Start will all income (wages, allowance)at the top, that’s the number they are working towards. The list of expenses for each month should start with needs down to wants. At the top of the list should be rent/mortgage, car payment, utilities and insurance. After that, they should list a number for savings. With bills paid and savings growing, they can use the rest of their money as discretionary income, available for wants and entertainment.

How to Plan Taxes

Before your child begins working, it’s a good idea for you to explain to them that everyone has a responsibility to pay taxes on their earned income. You can also explain how those taxes are used to support the city/state/country’s infrastructure. Without going into too much detail, they should know they have to pay SS, federal and state taxes at a minimum. It’s best to explain that approximately 30% of their earned income will go towards taxes.

After paying taxes all year, they then need to understand they have a responsibility to click here to get help filing a tax return by the prescribed IRS due date. As an incentive, you might remind them they could be due a refund that would fit nicely in their savings account.

About Borrowing

It’s okay to tell your kids they may need to borrow from time to time. They should know the difference between good credit (auto and home loans) and bad credit (credit cards). It’s also acceptable to explain there are mortgage lenders and auto lenders for those expenses, as well as online loan lenders, click for more info, which may provide relief in the case of unexpected personal emergencies. In this area, remind your child about the importance of paying all loans back as soon as possible.

Importance of Savings

Remember, kids, tend to live in the now. They don’t think much about the future. It’s your job to show them and teach them about the importance of savings. They need to realize emergencies don’t ask permission to occur. They need to have money set aside for emergencies. You need to also explain how important it is to start saving and investing in the future, including retirement. Show real-life examples to get the point across, but also make it fun so the lessons are easily remembered. If you take the time to make learning about money and savings fun it will create a lasting impression on your children and they will pass on those lessons to their children. The simplest way to start is with a good old fashioned piggy bank. You can get your kids something they love to stash allowance or extra change in then once a month match what they have saved. Another quick and fun way to show the importance of saving money is a fun bucket along with promised fun activities. Ask each kid to allocate a portion of their savings to the fun bucket each week and at the end of the month use that money for a fun family outing – just wait to see the unmistakable look of pride on their faces as they enjoy the day along with the realization that they made this happen!

The Importance of a Good Credit Rating

In this area, your emphasis should be on teaching them about how intermingled their credit rating is to their life. They should know first and foremost what credit is and how they start building it. Explain that a credit rating is earned only after you have credit. It is a common misconception that if you don’t have any outstanding debt that you automatically have a good credit rating – take the time to explain this is not the case and that you actually need to have, use and pay off debt in order to accumulate a good credit rating. Once they are older start discussing the more complicated aspects of how credit rating can affect your life like the impact it can have on employment opportunities, the ability to find suitable living quarters and the ability to buy major assets like a home or car. Tell them to pay their bills on time, all the time.

If you can share the above information with your child, they will likely be in the upper percentile of kids that know how to manage their personal finances. Your incentive to provide these lessons is the opportunity to prevent your child from having to rely on you for financial assistance.